What is the Three Year Rolling Period for CPD?

Of all the CPD requirements for Canadian CPAs, the three year rolling hours requirement may be the most confusing. This article will walk you through what this term means, the hours required for each period, and how to make sure you have no issues with compliance.

Single Year CPD Requirements:

Each year you are required to fulfill a minimum of 20 CPD hours with at least 10 of the hours being verifiable. Any amount above this if not required but can be recorded and used to fulfill multi-year requirements.

Triennial CPD Requirements:

In every three year period 120 total CPD hours are required, 60 of the hours must be verifiable. The makeup of these hours is up to the individual as long as the single year requirements are met.

Triennial Rolling Period:

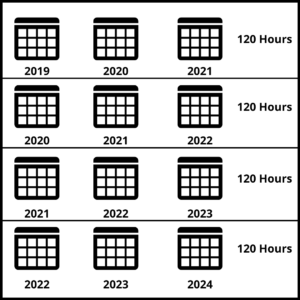

Starting this year, the fixed three year CPD period has been replaced with a rolling term. This means every new year the three year period shifts forward and the oldest year is removed. On January 1st, 2022 the year 2019 will be removed and the new three year period will be from 2020 to 2022.

Lets look at all of this with an example below. The first triennial period in this example spans from 2019 to 2021. In 2022 a new three year period begins covering 2020 to 2022. When this happens the hours from 2019 are dropped and the difference between your hours from 2020 and 2021 and the 120 hour minimum must be completed in 2022.

Hours Completed 2019 Hours Completed 2020 Hours Completed 2021 Minimum Hours Required 2022

40 40 40 40

30 50 40 30

50 30 40 50

Ethics CPD Requirement:

Starting in 2021, every three year period requires at least 4 verifiable hours of professional ethics CPD as part of the 120 hours.

Let’s look at the example again with ethics hours included. Similar to the total hours requirement, when the 2019 hours are dropped if your total ethics hours completed in 2020 and 2021 are below 4, you need to get the remainder in 2022.

2019 Hours Completed 2020 Hours Completed 2021 Hours Completed 2022 Hours Required

40, 2 Ethics Hours 40, 2 Ethics Hours 40, 0 Ethics Hours 40, 2 Ethics Hours

30, 4 Ethics Hours 50, 0 Ethics Hours 40, 0 Ethics Hours 30, 4 Ethics Hours

50, 4 Ethics Hours 30, 0 Ethics Hours 40, 3 Ethics Hours 50, 1 Ethics Hour

Proof of Completion:

You are required to retain documentation for all verifiable hours claimed over the three year period. This documentation is necessary to show proof of completion and provide the date the hours were earned. For every three year period you must have documentation for at least the minimum 60 hours of verifiable CPD required.

TL;DR

When every new year begins you should look at your previous two years. However many hours short of the 120 total CPD and 60 verifiable CPD requirements you are will need to be completed over the year.

With LumiQ you can store documentation for all hours gained on and off our platform with our CPD Tracker. With all information on one page it takes seconds to confirm compliance for the three year period. It also removes the risk of losing files and having to go back and redo hours. If you want to check out LumiQ and our CPD tracker, Sign up for our 5 hour free trial.