What is CPD?

Continuing Professional Development (CPD) is the term used to describe the ongoing learning that CPAs engage in to broaden their knowledge base and keep up to date on trends and developments in the industry. It is a yearly requirement for all CPAs to maintain their designation.

It can take time for new CPAs to absorb all the technicalities of the CPD requirements. This article is a short synopsis of everything you need to know about CPD, it’s requirements, and methods for getting the requisite hours.

CPD Requirements

Calendar Year: 20 total CPD hours, 10 must be verifiable.

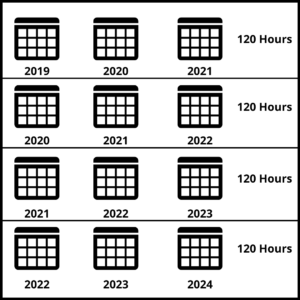

Previous Three Years: 120 total CPD hours, 60 must be verifiable.

Three Year Rolling Period

The triennial rolling year system was introduced in 2019 to replace the fixed three year system used previously. Within this system, as of every year of reporting you must have a total of 120 reported hours within the last three years, with 60 of them being verifiable, the makeup of these hours can be however you decide.

Rolling Period Year-By-Year

To look at an example, if you have 120 hours from 2019 to 2021 made up of 50 hours in 2019 and 35 hours in 2020 and 2021, you are required to complete 50 hours in 2022 to reach 120 hours in the new rolling period of 2020-2022.

Verifiable CPD Hours

As mentioned above, 50% of your CPD hours must be verifiable. Verifiable CPD requires there to be proof and verification of participation. You are required to have sufficient documentation to support your claimed hours.

Examples of some activities that can be used for CPD:

- Participation in a Course, Webinar, or Conference

- Online Learning that result in the completion of an Exam or Certification, this can include Podcasts, Video Learning, and Online Third Party Courses

- Teaching a Course or Seminar in an area of Professional Relevance.

- Professional Re-Examination or Re-Certification

- Participation on a Board or Committee (Audit Committee at Public Company or Non-Profit, CPA Board)

Documentation provided should describe the activity and when it took place, identify the provider of the activity, connect you to the activity, and provide reasoning that the number of hours claimed is reasonable.

You are required to hold on to any documentation for at least a five years following the reporting period.

Applicable Documentation can Include:

- Completion Certificate or Transcript

- Confirmation of Participation by Provider or Employer

- Attendance Record or Sign-In Sheet

- Course Assessment or Exam Results

- Copy of Outline or Agenda

- Payment Receipt/Invoice

Unverifiable CPD Hours

Unverifiable CPD hours include independent activities that are relevant to the position of the member that aren’t able to be verified using the above methods.

These can include but aren’t limited to:

- On-the-job software or new system training

- Learning that does not involve objective certification of completion like an examination, this can include online learning or conference or webinar related material

- Reading professional journals or magazines

Ethics Requirement

As of 2021, there is an additional Ethics component to the CPD requirement for CPAs. Four verifiable hours of Professional Ethics training is required as part of the 20 Verifiable hour requirement, This new requirement will become a component of the three year rolling period.

These hours can be acquired in one program or as a portion of any number of courses. Content must involve more than knowledge of the rules and must involve the application of the standards and guidelines in real and theoretical examples and scenarios.

Examples of some topics that fall under the ethics guidelines include:

- Regulatory updates relevant to role or industry

- Honesty in business practice

- Corporate social responsibility

- Bribery and corruption

- Whistle-blowing

CPD Audits

On a yearly basis, each Province selects a portion of the total CPD declarations and performs an audit to confirm compliance. If you are chosen to be audited you will be informed both in writing and electronically and are required to provide documentation within 30 days.

CPD Exemptions

Exemptions to the CPD requirements can be granted based on a number of different factors. In a number of provinces including Ontario, you can be granted a reduction or total exemption based on your total yearly income.

In addition, some of the most utilized reasons include:

- Maternity leave

- Unemployment

- Medical leave

- Compassionate circumstances.

If you are granted an exemption your three year rolling period is prorated based on the period of exemption granted. This does not apply to both the ethics requirement or the one year total in any future years.

New Member Requirements

New CPA members are responsible for their CPD hours as of their year of admission. There are exceptions for new members who have joined after graduating or completion of student programs, but for all other new members full completion is required as of the first year.

In Conclusion

To sum up all the information dumped on you here, understanding and complying with CPD is easy once you know what the specific regulations are.

It has long been a task dreaded by CPAs as wasting afternoons half asleep in conference rooms listening to the same presentations year after year. With the rise of online learning tools, there are more sources that actually provide interesting and engaging content.

How LumiQ fits in?

We are a service that works to make CPD content that fits the needs of today’s CPA. LumiQ provides CPAs with an avenue to get their hours anywhere at any time through short, digestible podcasts featuring some of Canada’s most renowned business figures.

If you’re interested in what we do and want to see how our platform and App works, click here to get 5 free hours of CPD.